Who We Are

Who We Serve

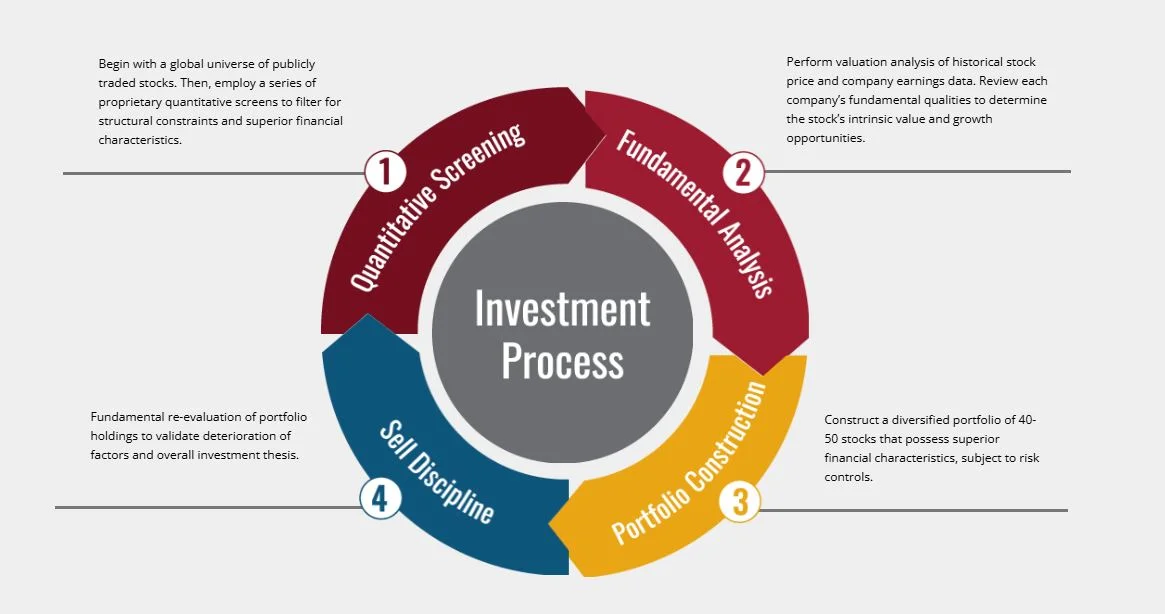

Level Four Capital Management offers actively managed equity portfolios across a range of investment styles. Our individual security portfolios deliver to clients a customized solution designed to achieve a client’s objective. Our professional team of portfolio managers employs a disciplined investment process, applying both quantitative analysis and fundamental research to construct diversified portfolios.

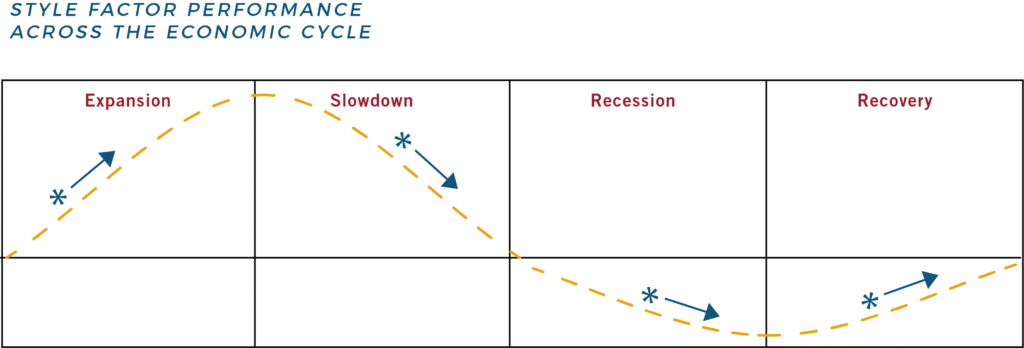

The investment committee adheres to a process that can be described as bottom-up, employing quantitative and fundamental analysis. We are data and research driven, always looking for evidence-based opportunities instead of listening to all the noise that exists related to investing. Our equity models are constructed utilizing a multi-step process. First, we begin with the entire universe of equity securities, which includes over 100,000 opportunities globally. We then employ a series of proprietary quantitative screens to filter for financial characteristics and multi-factor rankings. This is then followed by fundamental analysis to validate a company’s intrinsic value, investment efficiency and performance. Finally, we build a well-diversified portfolio, subject to risk controls. Furthermore, a defined sell discipline is employed to optimize the performance of these models.

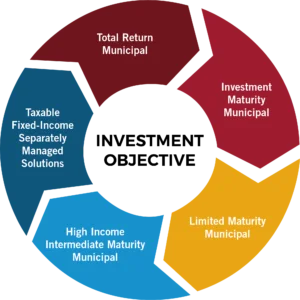

Individual bonds and portfolios of securities are quantitatively exposed to interest rate, yield curve, and credit spread movements or “shocks”.

Top-down review of core sectors is performed based on bottom-up analysis of individual credits to determine which municipal sectors should be over-weighted, neutral weighted, and underweighted.

New bond offerings are evaluated to determine portfolio suitability based on fundamental credit research on each borrower and individual bond security features.

Holdings are analyzed on a systematic basis to monitor any changes in credit trend. Credit rating momentum is monitored for each borrower (bond).

Key elements of the investment process include the following:

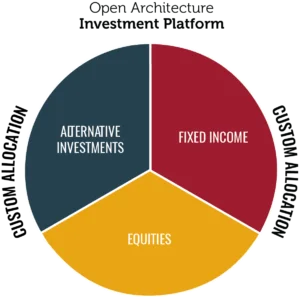

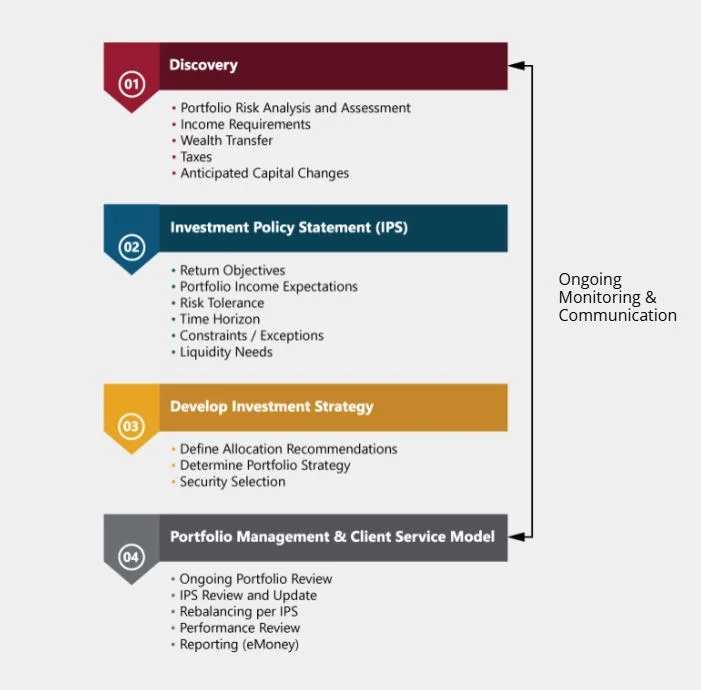

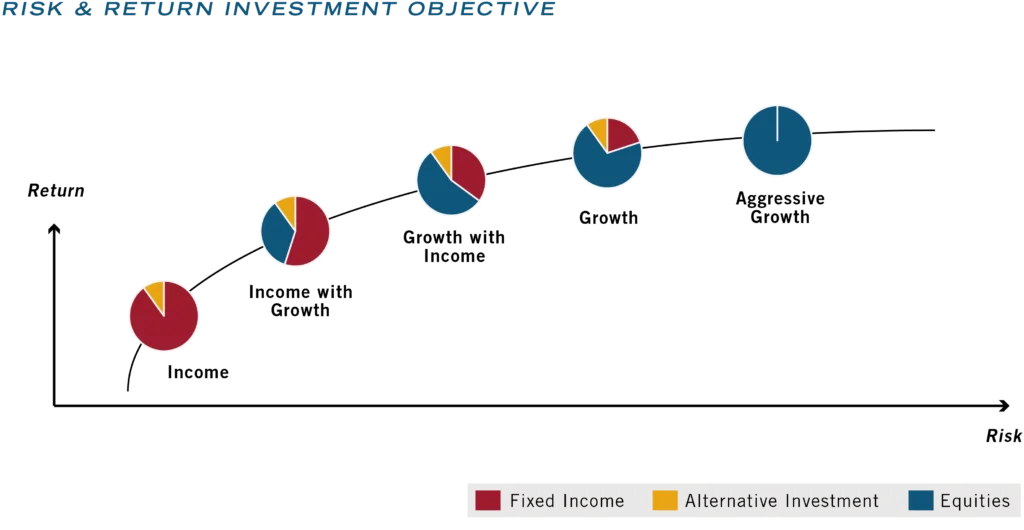

For clients seeking a comprehensive solution, our Asset Allocation models seek to provide the highest rate of return for a given level of risk. Our investment selection and allocation is based on our forward-looking capital market assumptions and in-depth investment screening process to optimize the appropriate mix of equity, bond, and alternative investments.

Investment advice offered through Level Four Capital Management, LLC, an SEC registered investment advisor. The content herein is derived from sources believe to be reliable and accurate. The information contained herein is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for informational purposes only, and should not be considered as a solicitation for the purchase or sale of any security.

Check the background of your Financial Professional on FINRA’s BrokerCheck. We take protecting you data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information. © 2021 Level Four Financial, LLC Member FINRA/SIPC Disclosures Representative Login | Representative Email

Investment advice offered through Level Four Capital Management, LLC, an SEC registered investment advisor. The content herein is derived from sources believe to be reliable and accurate. The information contained herein is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for informational purposes only, and should not be considered as a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Securities offered through Level Four Financial, LLC, a registered broker dealer and member of FINRA/SIPC. Advisory services are offered through Level Four Advisory Services, LLC, an SEC-registered investment advisor. Accounts carried by Raymond James & Associates, Inc. Member New York Stock Exchange/SIPC. Neither Level Four Financial, LLC nor Level Four Advisory Services, LLC offer tax or legal advice. Please contact your tax or legal professional for specific information regarding your individual situation. Level Four Financial Registered Representatives associated with this site may discuss and/or transact securities business only with residents in states where they are registered. Please refer to https://brokercheck.finra.org for additional information.