Check the background of your financial professional on FINRA's

BrokerCheck.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

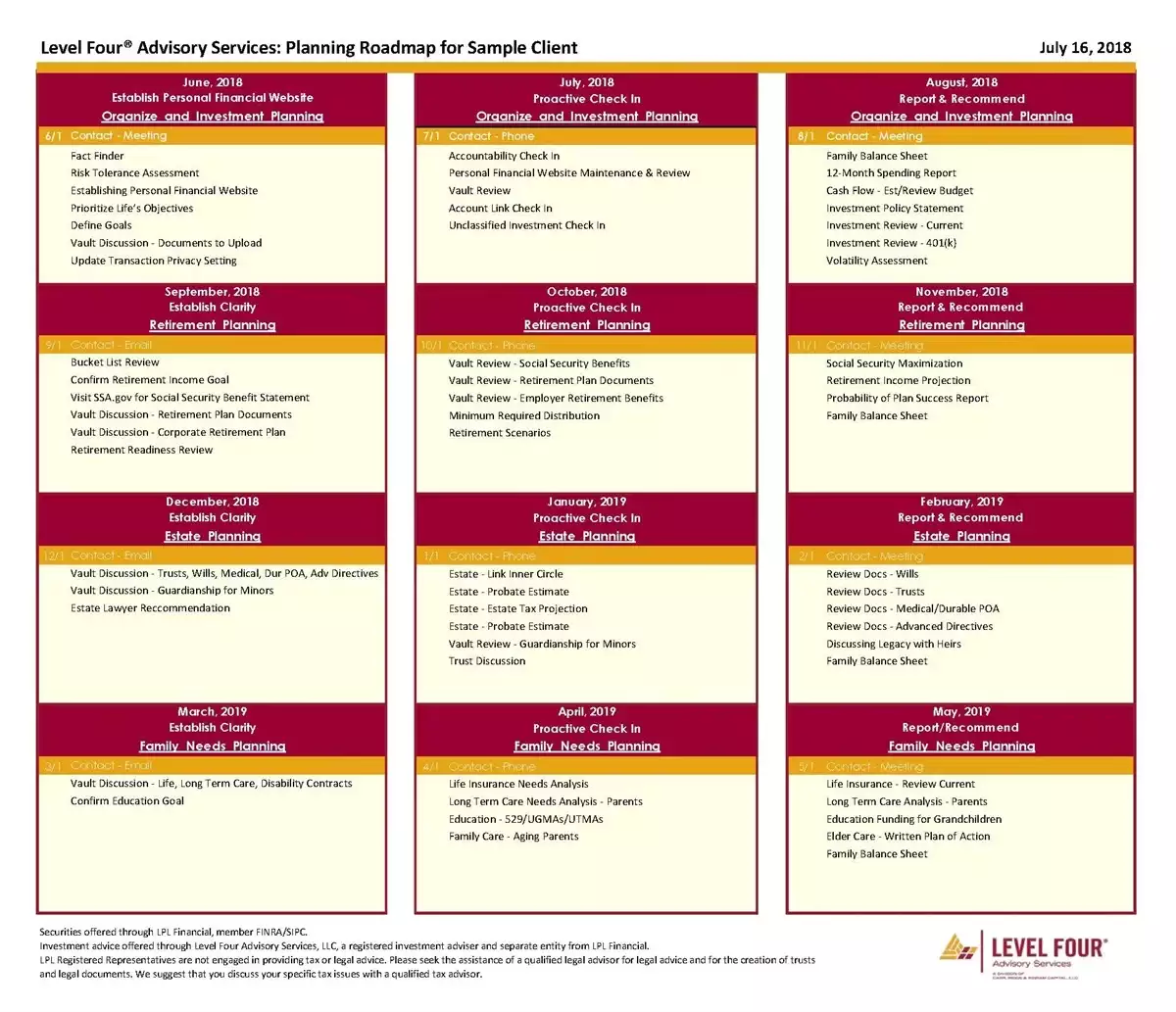

Securities offered through Level Four Financial, LLC, a registered broker dealer and member of

FINRA/

SIPC. Advisory services are offered through Level Four Advisory Services, LLC, an SEC-registered investment advisor. Accounts carried by Raymond James & Associates, Inc. Member New York Stock Exchange/

SIPC. Neither Level Four Financial, LLC nor Level Four Advisory Services, LLC offer tax or legal advice. Please contact your tax or legal professional for specific information regarding your individual situation.

Level Four Financial Registered Representatives associated with this site may discuss and/or transact securities business only with residents in states where they are registered. Please refer to

https://brokercheck.finra.org for additional information.