Having been in the offices of hundreds of CPA’s and hundreds of financial advisors, I can say there are millions and millions of dollars of untapped revenue that both of these firms are missing out on, and there are two big reasons: TRUST and GREED.

Let me first address the CPA. You’ve worked hard for years building your practice while offering quality service and great advice to your clients. You’re proud of your practice, you’re proud of your client base, and you protect your reputation fiercely. The last thing you would ever stand for is to expose your clients to someone you didn’t know or trust and risk them damaging your relationship with your clients or tarnishing your reputation.

But that’s only half the problem. Over the past five years clients have gone out of business, been laid off, or just become much more timid and conservative. Your clients are cutting back, and things have become more competitive. So, in many cases, your revenue is flat or shrinking even though your overhead continues to rise.

Like all professionals, you know there are only so many hours you can work in a given week. As a result, your ability to grow your income is limited. But you also know that your clients have needs that you could be serving that would more than compensate for the shrinkage and marketing challenges you face. But, how do you do it without stepping into the unknown and taking a big risk?

Now I’d like to address the advisor. Like my professional CPA friends, you love your work, but you don’t love marketing. Bringing in new business represents an obstacle that you will always face. You may or may not have realized that if you could partner together with an established, successful CPA that it would change your future and the success of your business. However, the ability to establish a business relationship somehow gets stalled or you face resistance from that CPA due to uncertainty.

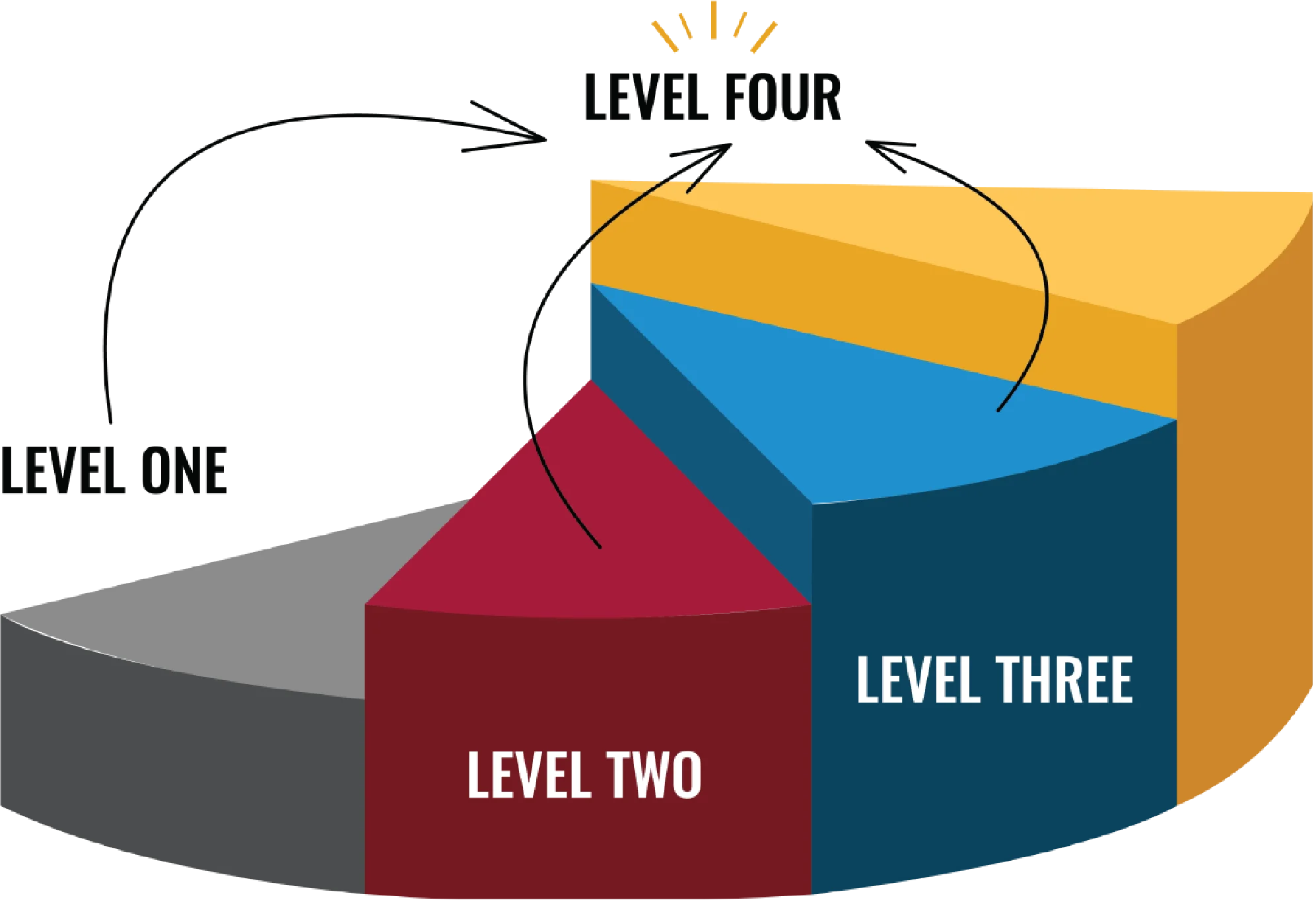

Now I’d like to address both of you. Being an advisor myself, owning an accounting firm, and working with many CPA’s and financial advisors over the years has forced me to develop a system that eliminates all of those issues that get in the way of the greater success for both parties. Our mission at Level Four® is to help bridge the gap between CPA’s and advisors with the end result being greater revenue and value for both parties involved through a synergistic relationship.

Let me show you how we can bring added value and revenue to your practice. Give us a call today and learn how we can help you take your practice to the next level.

Sincerely,

Have you defined your niche? Studies show that a significant gap exists between what wealthy investors expect from their advisors what they actually receive. Clients want holistic yet specialized advice from advisors with subject matter expertise. Level Four utilizes an ensemble team approach to ensure our advisors can meet the demands of modern day investors. We want to help you grow you book of business bigger and faster as you develop your skill set through our resources and areas of expertise.

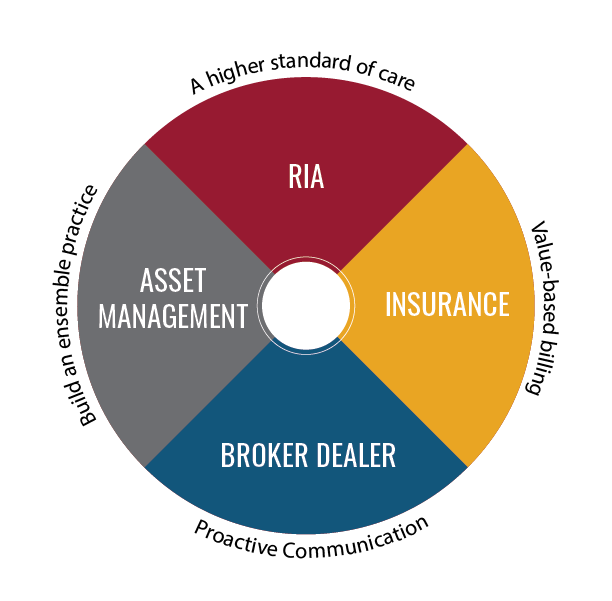

Level Four represents a group of dedicated and experienced financial services business partners to the accounting and financial advisory professions.

It is the passion of Level Four to provide multi-partner accounting firms, motivated sole practitioners, and traditional financial advisors with the key to unlock their potential in the financial services marketplace. The Level Four model enables individuals and firms to embrace and achieve the concept of a multi-disciplinary practice. Firms can now excel by providing truly comprehensive tax, risk management, and financial advisory services to their existing and prospective clients.

We want to help you develop your skill set and provide resources that allow you to focus on what you do best. Focus and depth of knowledge is a necessity in your ability to build and grow relationships.

As you focus on your area of expertise, our team of specialists provide in-depth knowledge to supplement your current offerings. Eventually building your own team allows for growth.

Our tried and true model is one that defines the scope of our engagement from the get-go. Our unique menu allows our clients to pick and choose their priorities and our road map forecasts future meetings and interaction. Our processes allow you to elevate the client experience from reactive to proactive service.

Through our vast network you’ll have access to the community of Level Four and leverage the experience of your peers. For qualified candidates, relationships can be formed with our parent company and have the opportunity to work alongside CPAs, investment bankers, management consultants and more.

We understand that every individual is unique and we will work with you to determine the model that best supports your goals. We offer multiple affiliation options to join Level Four and ways to implement the best fit for you and your business.

We are dedicated to serving our advisors with every aspect of their practice. Our services encompass three platforms integral to the daily operations and long-term growth.

New Business Review & Support, Concierge Proactive Service Team, Compliance & Regulatory Outsourcing, File Management & CRM Technology, Transition Resources

Fiduciary Level Advice, Value Based Fee-for-service Pricing, Multiple Custodial Options, Open Architecture Software & Research Technology, Institutional Asset Management, In-house Investment Committee

Advanced Market Support, On Site Point-of-Sale Support, New Business Marketing & Sales, Licensing & Contracting Technologies, Dedicated Case Management Team, Commission & Accounting Services, Agency Management Technology, Brokerage Access: 100+ Carriers

A recent industry survey asked advisors who changed firms within the past three years what influenced their decision. The top three factors were:

We also know that the most important part of your decision-making is Your Clients. We provide a Remarkable Client Experience in addition to the advisor experience.

Check the background of your Financial Professional on FINRA’s BrokerCheck. We take protecting you data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information. © 2021 Level Four Financial, LLC Member FINRA/SIPC Disclosures Representative Login | Representative Email

Investment advice offered through Level Four Capital Management, LLC, an SEC registered investment advisor. The content herein is derived from sources believe to be reliable and accurate. The information contained herein is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for informational purposes only, and should not be considered as a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Securities offered through Level Four Financial, LLC, a registered broker dealer and member of FINRA/SIPC. Advisory services are offered through Level Four Advisory Services, LLC, an SEC-registered investment advisor. Accounts carried by Raymond James & Associates, Inc. Member New York Stock Exchange/SIPC. Neither Level Four Financial, LLC nor Level Four Advisory Services, LLC offer tax or legal advice. Please contact your tax or legal professional for specific information regarding your individual situation. Level Four Financial Registered Representatives associated with this site may discuss and/or transact securities business only with residents in states where they are registered. Please refer to https://brokercheck.finra.org for additional information.